Overview

Joint-Stock Commercial Bank "Business Development Bank" is a systemically important financial institution focused on contributing to the country's economic growth through the comprehensive support of the small and medium-sized enterprise segment. The Bank's activities are based not only on financing entrepreneurial initiatives but also on supporting them at every stage of their strategic development.

The Bank's Transformation and History

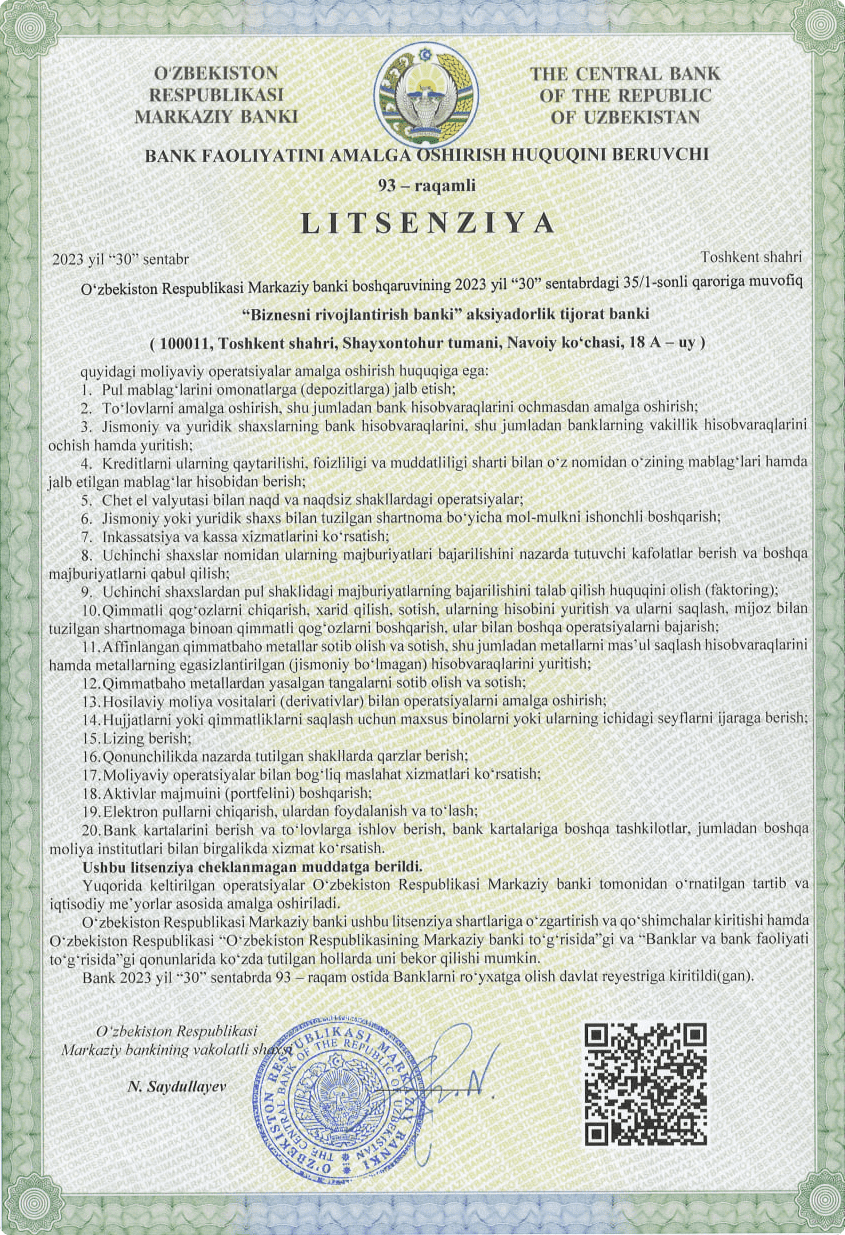

The Bank began its long-standing history on the foundation of JSCB "Qishloq Qurilish Bank," which was focused on developing the country's agricultural and social sectors. In line with the new era of economic reforms in Uzbekistan and the strategic priority of supporting entrepreneurship, the bank was transformed into JSCB "Business Development Bank" by the Decree of the President of the Republic of Uzbekistan No. PP-292, dated September 4, 2023. This signifies a fundamental overhaul of the bank's mission, corporate strategy, and operational model.

The Bank's Mission

Our mission is to serve society, the nation, and businesses. We are your reliable partner on the journey to success.

Corporate Values

Better: We continuously seek improvement by implementing advanced technologies and processes to deliver exceptional results and experiences for our clients.

Dedicated: We are committed to meeting the needs of our clients, addressing their concerns promptly, and delivering personalized service.

Beyond: We aim to exceed expectations by offering innovative, tailored solutions that go beyond traditional banking services.

Nationwide Operations

The Bank has a wide branch network throughout Uzbekistan. Today, high-quality services are provided to entrepreneurs through more than 50 branches and banking service centers in all regions of the republic.

The Entrepreneurial Ecosystem

The Bank is not limited to traditional financing; it forms a full-cycle ecosystem for entrepreneurship. The Bank's structure includes 19 specialized subsidiary companies, including:

"Small Business Assistance Centers": Centers in each region that provide practical support to entrepreneurs in launching and managing their businesses.

Specialized Financial Institutions: Subsidiary structures such as "BRB-CAPITAL" and "BRB-TECH" that provide services in investment, leasing, factoring, and microfinance.

Financial Stability and Transparency

The Bank conducts its operations based on international standards and strictly adheres to the principles of transparency. The Bank's financial statements are prepared in accordance with International Financial Reporting Standards (IFRS) and are regularly reviewed by reputable international audit firms, such as KPMG.

Key Financial Indicators (as of June 30, 2025):

Total Assets: UZS 35.4 trillion (a 12% increase compared to the end of the previous year).

Total Capital: UZS 3.4 trillion (a 25% increase compared to the end of the previous year).

Net Profit: UZS 192.7 billion (a significant positive trend compared to the financial result for the same period last year).

These indicators confirm the bank's solid financial foundation, sustainable growth potential, and the effectiveness of its corporate governance.

With its solid financial foundation, extensive infrastructure, and professional team, JSCB "Business Development Bank" continues to fulfill its important mission of developing entrepreneurship and strengthening the national economy in Uzbekistan.